NARFE Supports Windfall Elimination Provision Reform Bill Introduced by Rep. Arrington

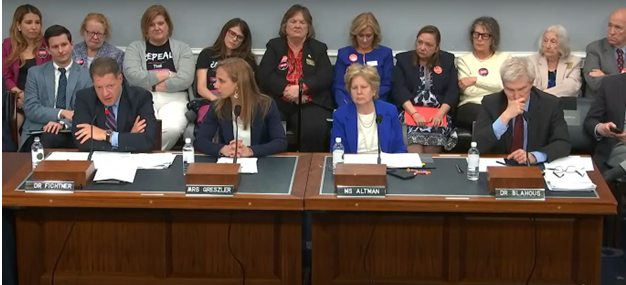

Alexandria, Va. – In response to Rep. Jodey Arrington, R-TX, introducing the Equal Treatment of Public Servants Act, legislation that would provide much-needed relief to civil servants financially punished by the Windfall Elimination Provision (WEP), NARFE National President William Shackelford issued the following statement:

“Since its inception, NARFE has opposed the WEP as unfairly punishing hardworking public servants through reduced Social Security benefits. Congressman Arrington’s bill today delivers yet another path toward a workable solution to this decades-old concern for those who devoted their careers serving the public.

“While NARFE’s ultimate goal is for Congress to fully repeal the WEP and the GPO, reform efforts such as the Equal Treatment of Public Servants Act are a good first step toward correcting this discriminatory provision. What’s crucial now is for members of both parties to seek common ground and finally provide relief to WEP-affected retirees.”

Members of both parties have introduced other pieces of legislation with similar goals during the 118th Congress, which NARFE supports:

- In January, Reps. Garrett Graves, R-LA, and Abigail Spanberger, D-VA, and Sens. Sherrod Brown, D-OH, and Susan Collins, R-ME, introduced the Social Security Fairness Act, H.R. 82/S. 597, which would fully repeal the WEP and Government Pension Offset (GPO).

- In June, House Ways and Means Committee Ranking Member Richard Neal, D-MA, introduced the Public Servants Protection and Fairness Act of 2023, H.R. 4260, which would provide some relief from the WEP for both current and future retirees. While the legislation does not fully repeal WEP, it represents a significant improvement over the status quo for the Civil Service Retirement System (CSRS) retirees unfairly penalized for their public service.

- In July, Rep. John Larson, D-CT, and Sen. Richard Blumenthal, D-CT, introduced the Social Security 2100 Act, H.R. 4583/ S. 2280, which would fortify the Social Security program and expand benefits. Most notably, the bill would fully repeal WEP and GPO. In addition, the bill would increase the average Social Security benefit, improve cost-of-living adjustments, index Social Security wage levels, and more.

Background

- The WEP reduces the Social Security benefits of local, state and federal retirees who worked in Social Security-covered employment (e.g., private-sector jobs) and who also receive a government annuity from their non-Social Security covered government employment (e.g. federal employment covered by the Civil Service Retirement System).

- Normally, Social Security benefits are calculated using a progressive formula in which an individual’s Average Indexed Monthly Earnings (AIME) are multiplied by three progressive factors—90 percent, 32 percent and 15 percent—at different levels of AIME, resulting in the basic monthly benefit. In 2023, the first $1,115 of AIME is multiplied by 90 percent. AIME of more than $1,115 through $6,721 is multiplied by 32 percent; AIME of more than $6,721 is multiplied by 15 percent. All three products are added together to produce the regular Social Security benefit. Under the WEP, the 90 percent factor is reduced to as low as 40 percent. .

- According to the Congressional Research Service, as of December 2022, the WEP affects 2,013,310 beneficiaries, including 1,910,130 retired workers, 11,870 workers with disabilities, and 91,310 spouses and children. In 2023, the WEP can result in a monthly benefit that is $558 lower than under the regular benefit formula. For a state-by-state breakdown of the WEP, please click here.

- Once in effect, the bill would reduce the WEP penalty by $100 per month ($50 for surviving spouses)—increasing the Social Security benefit—for those already eligible for Social Security (including those who have already claimed the benefit). It would provide a new formula for future beneficiaries that has been estimated to increase benefits for those affected by WEP now; and ensure newly eligible individuals receive the higher benefit from the old or new formula through the 2060s.

# # #

As the only organization solely dedicated to the general welfare of all federal workers and retirees, NARFE delivers valuable guidance, timely resources and powerful advocacy. For 100 years, NARFE has been a trusted source of knowledge for the federal community, Capitol Hill, the executive branch and the media.

CONTACT:

Jenn Rafael

NARFE Director of Communications and Marketing

jrafael@narfe.org | (571) 483-1270